Diving into life insurance plans, get ready to explore the different types, key factors to consider, coverage options, premiums, and why having a plan is crucial for financial security. Strap in for a ride through the world of life insurance!

Types of Life Insurance Plans

Life insurance plans come in various types, each designed to meet different needs and financial goals. The main types include term life insurance, whole life insurance, and universal life insurance. Let’s take a closer look at these options.

Term Life Insurance vs. Whole Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiary if the policyholder passes away during the term. On the other hand, whole life insurance provides coverage for the entire lifetime of the insured individual and includes a cash value component that grows over time.

- Term Life Insurance:

- Lower premiums compared to whole life insurance

- Provides coverage for a specific period

- Does not accumulate cash value

- Renewable at the end of the term

- Whole Life Insurance:

- Higher premiums but guaranteed coverage for life

- Includes a cash value component that grows over time

- Can be used for loans or withdrawals

- Offers lifelong protection and investment benefits

Benefits of Universal Life Insurance

Universal life insurance is a flexible policy that combines the benefits of life insurance with an investment component. It offers the policyholder the ability to adjust premium payments and death benefits based on their changing needs and financial situation.

- Provides flexibility in premium payments and death benefits

- Accumulates cash value over time

- Offers potential for higher returns compared to traditional whole life insurance

- Allows for loans or withdrawals against the cash value

Factors to Consider When Choosing a Life Insurance Plan

When selecting a life insurance plan, it is crucial to evaluate various factors to ensure that the chosen plan aligns with your specific needs and goals. Factors such as age, health status, financial objectives, lifestyle, and number of dependents play a significant role in determining the most suitable life insurance policy.

Assessing Financial Needs

Determining your financial needs is the first step in choosing a life insurance plan. Consider factors such as outstanding debts, mortgage payments, education expenses for children, and the financial support needed for your dependents in the event of your passing.

Key Factors Influencing Choice

- Age: Younger individuals typically pay lower premiums for life insurance, so age is an important factor to consider when selecting a plan.

- Health: Your current health status and medical history can impact the type of life insurance you qualify for and the premium rates you will pay.

- Financial Goals: Your long-term financial objectives, such as saving for retirement or leaving a legacy for your loved ones, should guide your choice of a life insurance plan.

Lifestyle and Dependents

- Lifestyle: Certain lifestyle choices, such as engaging in high-risk activities or having a dangerous occupation, can affect your life insurance options and premiums.

- Dependents: Consider the number of dependents you have and their financial needs when deciding on the coverage amount and duration of your life insurance policy.

Coverage Options and Riders

When it comes to life insurance plans, there are various coverage options and riders that can be added to enhance the policy and provide additional benefits to the policyholder and their loved ones.

Coverage Options, Life insurance plans

- Term Life Insurance: Provides coverage for a specific period of time.

- Whole Life Insurance: Offers coverage for the entire lifetime of the policyholder.

- Universal Life Insurance: Combines a death benefit with a savings component.

Common Riders

- Accidental Death Benefit Rider: Provides an additional benefit if the policyholder dies as a result of an accident.

- Critical Illness Rider: Offers a lump-sum payment if the policyholder is diagnosed with a critical illness.

- Waiver of Premium Rider: Waives premium payments if the policyholder becomes disabled and is unable to work.

Adding riders to a life insurance plan can enhance the coverage and provide extra protection to the policyholder and their beneficiaries. It allows for customization of the policy to meet specific needs and circumstances, ensuring that the policy provides comprehensive coverage in various situations.

Premiums, Payouts, and Policy Terms

Life insurance premiums are calculated based on various factors such as the age, health, and lifestyle of the policyholder. The higher the risk the insurance company perceives, the higher the premium will be. Premiums can be paid monthly, quarterly, semi-annually, or annually, depending on the policy terms.

Premium Calculation

- Age, health, and lifestyle are key factors in determining premiums.

- Higher risk individuals will have higher premiums.

- Payment frequency can vary based on policy terms.

Payout Options

- Beneficiaries can choose to receive the death benefit as a lump sum payment.

- Other options include receiving the benefit as a monthly income stream or a combination of both.

- Payout options should align with the financial needs of the beneficiaries.

Policy Terms Significance

- Policy terms Artikel the duration of coverage and premium payment.

- Longer terms may result in higher premiums but offer more extended protection.

- Understanding policy terms is crucial to maximizing coverage and benefits.

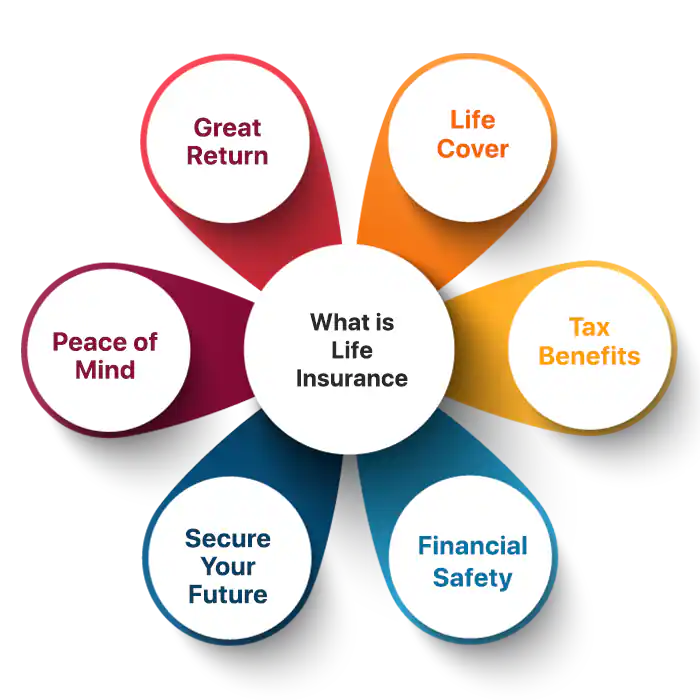

Importance of Life Insurance Planning: Life Insurance Plans

Life insurance planning is a crucial aspect of financial planning that provides a safety net for your loved ones in case of unforeseen circumstances. By having a life insurance plan in place, you can ensure that your family is protected financially and can maintain their quality of life even after you’re gone.

Life insurance can provide financial security and peace of mind for your loved ones during difficult times. It can help cover expenses such as mortgage payments, children’s education, daily living costs, and even funeral expenses. Knowing that your family will be taken care of can alleviate a significant amount of stress and uncertainty.

Real-life examples demonstrate how life insurance has played a vital role in families’ financial well-being. For instance, a family who lost their primary breadwinner due to a sudden illness was able to cover their expenses and continue living comfortably because of the life insurance policy in place. This highlights the importance of having a comprehensive life insurance plan to protect your family’s future.