When it comes to the insurance claims process, buckle up for a wild ride through the intricate world of claims, investigations, and settlements. From the initial documentation to the final appeal, get ready to dive deep into the realm of insurance mysteries and resolutions.

Exploring the different types of claims, the crucial documentation needed, and the intricate investigation process, this journey will shed light on the complexities and challenges faced by both insurers and policyholders alike.

Overview of Insurance Claims Process

When it comes to dealing with insurance claims, there are several key steps that both insurers and policyholders need to navigate. Understanding the process can help ensure a smoother experience for all parties involved.

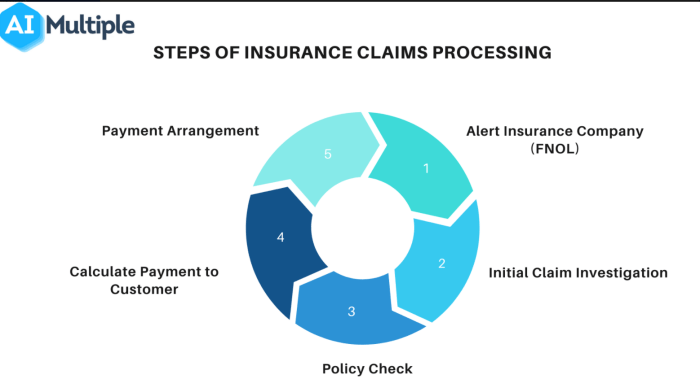

General Steps in an Insurance Claims Process

- Reporting the Claim: The first step is for the policyholder to report the claim to their insurance company. This can usually be done online, over the phone, or through a mobile app.

- Investigation: Once the claim is reported, the insurance company will investigate the details to determine coverage and liability.

- Assessment: After the investigation, the insurance adjuster will assess the damage or loss and provide an estimate for the claim.

- Negotiation: If there are disagreements about the claim amount, negotiation between the insurer and the policyholder may take place.

- Settlement: Once an agreement is reached, the claim is settled, and the policyholder receives the appropriate compensation.

- Resolution: The final step involves closing the claim and ensuring that all parties are satisfied with the outcome.

Key Parties Involved in Handling Insurance Claims

- Policyholder: The individual or entity that holds the insurance policy and makes a claim for coverage.

- Insurance Company: The organization that provides the insurance coverage and processes the claim.

- Insurance Adjuster: The person responsible for investigating and assessing the claim on behalf of the insurance company.

- Legal Counsel: In some cases, legal counsel may be involved to resolve disputes or provide guidance during the claims process.

Importance of an Efficient Insurance Claims Process

An efficient insurance claims process is crucial for both insurers and policyholders. For insurers, it helps streamline operations, reduce costs, and maintain customer satisfaction. For policyholders, it ensures timely compensation, quick resolution of claims, and overall peace of mind knowing their coverage is reliable in times of need.

Types of Insurance Claims

When it comes to insurance claims, there are different types that individuals may encounter depending on their policy and situation. Let’s take a look at the main types of insurance claims and how they differ from each other.

First-Party vs. Third-Party Insurance Claims

First-party insurance claims are filed by the policyholder to their own insurance company to cover their own losses or damages. This type of claim is common in auto insurance when the policyholder gets into an accident. On the other hand, third-party insurance claims are filed against the insurance of another person who is at fault for the damages or injuries caused. For example, if you get into an accident with someone else and they are at fault, you would file a third-party claim with their insurance company.

Types of Insurance Claims

- Auto Insurance Claims: These claims are filed to cover damages or injuries resulting from a car accident. For example, if your car is damaged in a collision, you would file an auto insurance claim to have the repairs covered.

- Property Insurance Claims: Property insurance claims are filed to cover damage or loss to your property, such as your home or belongings, due to events like fires, theft, or natural disasters.

- Health Insurance Claims: Health insurance claims are submitted to cover medical expenses, treatments, or procedures. For instance, if you visit the doctor for a check-up, you would file a health insurance claim to have the cost covered.

- Life Insurance Claims: These claims are made by beneficiaries of a life insurance policy after the policyholder passes away. The beneficiaries would file a claim to receive the death benefit from the policy.

Documentation and Information Required: Insurance Claims Process

When filing an insurance claim, it is crucial to gather and provide the necessary documentation to support your request. This documentation helps insurance companies assess the validity of the claim and determine the appropriate coverage. Providing accurate information is key to ensuring a smooth claims process and receiving the compensation you are entitled to. Here’s a breakdown of the documentation and information required:

Necessary Documentation

- Policy details: Provide your insurance policy number, coverage details, and any relevant endorsements.

- Incident report: Submit a detailed report of the incident that led to the claim, including date, time, location, and description of the events.

- Evidence of loss: Include photos, videos, or any other evidence that supports your claim, such as damaged property or injuries.

- Police report: If applicable, provide a copy of the police report filed in relation to the incident.

- Medical records: For health insurance claims, include medical records, bills, and receipts related to the treatment received.

Importance of Accuracy

Accurate information is crucial when filing an insurance claim as it helps prevent delays or denials in processing. Providing false or misleading information can lead to claim rejection and possible legal consequences. By ensuring all details are correct and supported by documentation, policyholders can expedite the claims process and increase the likelihood of a successful outcome.

Gathering and Organizing Information Efficiently, Insurance claims process

- Create a checklist: Make a list of all required documentation and information to ensure nothing is overlooked.

- Organize files: Keep all documents related to the claim in a designated folder or binder for easy access.

- Stay proactive: Follow up with any additional information requested by the insurance company promptly to avoid delays.

- Seek assistance: If you are unsure about the documentation needed, reach out to your insurance agent or company for guidance.

Investigation Process

When it comes to handling insurance claims, the investigation process plays a crucial role in determining coverage and liability. Insurance companies need to thoroughly assess the situation before making any decisions.

Role of Adjusters and Appraisers

Adjusters and appraisers are the key players in assessing damages and losses in insurance claims. Adjusters investigate the claim, gather information, and evaluate the extent of the damage. They work closely with appraisers who determine the value of the loss and provide estimates for repairs or replacements.

- Adjusters conduct interviews with the policyholder, witnesses, and other involved parties to gather information.

- They inspect the damage firsthand and review any relevant documentation, such as police reports or medical records.

- Appraisers use their expertise to assess the value of the loss and provide detailed estimates for repairs or replacements.

- Both adjusters and appraisers work together to ensure that the claim is handled fairly and accurately.

It is essential for adjusters and appraisers to be thorough and meticulous in their investigation to ensure that the claim is processed correctly.

Methods for Investigating Fraudulent Claims

Insurance companies employ various methods to investigate suspicious or fraudulent claims to protect themselves from potential fraudsters. These methods help in detecting any inconsistencies or red flags in the claim.

- Surveillance: Insurance companies may conduct surveillance on claimants to verify the extent of their injuries or damages.

- Background Checks: Checking the claimant’s background for any previous claims or criminal records can help in identifying potential fraud.

- Forensic Analysis: Utilizing forensic techniques to analyze documents, evidence, and other relevant information to uncover any signs of fraud.

- Interviews and Statements: Conducting detailed interviews and analyzing statements to identify any discrepancies in the claimant’s story.

Claim Settlement

When it comes to settling an insurance claim, there are several factors that can influence the final settlement amount. These factors include the type of insurance coverage, the extent of the damages or losses, the policy limits, and any deductibles that may apply. Insurance companies also take into account the documentation and evidence provided by the policyholder to support their claim.

Factors Influencing Settlement Amount

- Extent of Damages/Losses: The more extensive the damages or losses, the higher the settlement amount is likely to be.

- Policy Limits: The maximum amount the insurance policy will pay out can affect the final settlement.

- Evidence Provided: Strong documentation and evidence to support the claim can lead to a higher settlement.

- Deductibles: The amount the policyholder is required to pay out of pocket before the insurance coverage kicks in.

Negotiation Strategies for Policyholders

- Be Prepared: Have all necessary documentation and evidence ready to support your claim.

- Know Your Policy: Understand the coverage and limits of your insurance policy to negotiate effectively.

- Be Persistent: Don’t be afraid to push for a fair settlement and advocate for yourself.

- Consider Hiring a Public Adjuster: A public adjuster can help navigate the claims process and negotiate on your behalf.

Ways to Settle Insurance Claims

- Reimbursement: The insurance company reimburses the policyholder for the covered losses or damages.

- Replacement: The insurance company provides funds to replace the damaged property or items.

- Repair: The insurance company pays for the repair of the damaged property or items.

Appeals and Disputes

When an insurance claim is denied, policyholders have the option to appeal the decision. This process allows them to challenge the denial and provide additional information or evidence to support their claim.

Appealing a Denied Claim

- Policyholders can start the appeals process by contacting their insurance company and requesting a review of the denied claim.

- They may need to submit additional documentation or information to support their case, such as medical records, repair estimates, or witness statements.

- Insurance companies will reassess the claim based on the new information provided and make a final decision on whether to approve or deny the appeal.

Common Reasons for Claim Denials

- Incorrect or incomplete information provided in the initial claim.

- Policy exclusions that apply to the specific situation.

- Discrepancies between the policy terms and the actual circumstances of the claim.

Disputing Claim Denials

- If a policyholder disagrees with the outcome of the appeal, they can escalate the dispute further.

- This may involve mediation, arbitration, or taking legal action against the insurance company.

- Policyholders should review their policy carefully and seek legal advice if necessary to understand their rights and options in disputing a claim denial.